While Singaporean Pundits May Fixate on the Unexpected Fall in NODX, the Real Story is the Alarming Long Term Drop in Consumption and Rise in Net Exports as a Percentage of GDP

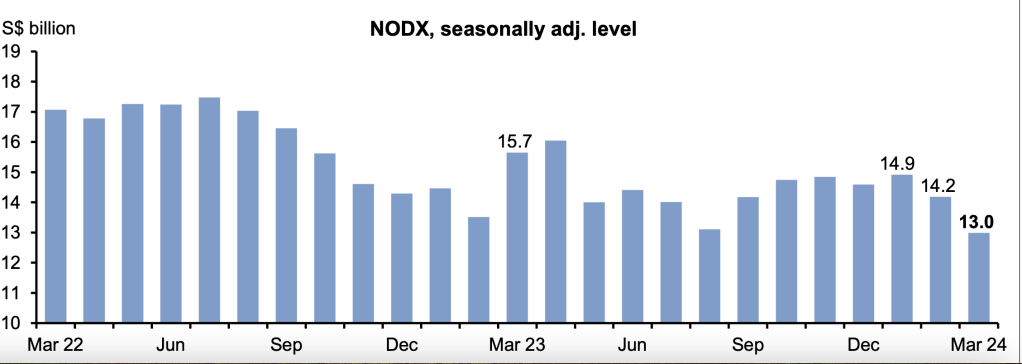

Enterprise Singapore recently published data showing a year-on-year decline in Non-Oil Domestic Exports (NODX) of 20.7% in March, which was significantly worse than most economists expected. This was made worse by a high base in March 2023 which makes it more appropriate to look at the month-on-month seasonally adjusted figures. These were equally bad showing a decline of 8.4% in March following a 4.9% decrease the previous month (the year-on-year figure for February 2024 showed a 0.2% decline).

However this graph from Enterprise Singapore shows there has been no clear trend in NODX, with a peak in July 2022 not having been surpassed since. Once adjusted for inflation the trend would clearly be downwards.

Looking at NODX in isolation tells only one part of the picture though. As every first year (indeed every A Level) Economics student knows, exports are only one component of Gross Domestic Product (GDP). GDP, when measured from the expenditure side, is the sum of Private Consumption (C) Government Curent Spending (G), Domestic Investment (I) and Net Exports (Exports [X] of Goods and Services Minus Imports [M]). The familiar equation is

C + G + I + (X-M) = GDP

If we look at the expenditure components of GDP going back ten years, then it’s possible to see some alarming trends. While total GDP at current prices was some $673 billion in 2023, private consumption expenditure had declined from 37% of GDP in 2013 to only 31% of GDP in 2023. Meanwhile net exports rose from 23% of GDP in 2013 to 37% in 2023. This illustrates just how unbalanced the Singapore economy has become with the PAP holding down domestic consumption to increase net exports (by reducing imports consumed domestically). By contrast private consumption expenditures in most developed economies like the US are close to 70%. Not only has consumption fallen precipitously as a share of GDP. Investment, or Gross Fixed Capital Formation, has declined from 28% of GDP in 2013 to only 22% in 2023.

This is not just a theoretical exercise. A declining share of consumption in GDP accords with what many Singaporeans are experiencing which is a sense of relative impoverishment. They are struggling to make ends meet with much higher costs than consumers in other advanced countries and much lower wages per hour. It’s abundantly clear that the PAP Government are tightening the screws on ordinary SIngaporeans in order to generate bigger and bigger surpluses, which are hidden from you in our charade of a Budget. While Government Consumption appears to be keeping pace with the growth of nominal GDP, I have highlighted how a significant amount of the Budget uses accounting tricks to channel so-called current expenditures into the reserves, such as with HDB subsidies and the transfer of the Net Investment Returns Contribution (NIRC) into long term funds and endowments. Not only are the PAP crushing consumption, they are failing to invest in Singapore in favour of converting an increasing proportion of wealth into overseas assets, beyond your reach under the Constitution. as it currently stands The PAP refuse to give you an accounting of these assets or explain why it’s necessary to screw the current and past generations of Singaporeans so badly to build up such enormous reserves. This is particularly the case when the ultimate beneficiaries remain unclear but are unlikely to be many native-born citizens at current fertility rates.

So whenever seat-warmer Lawrence Wong gets misty-eyed as he utters mendacious twaddle like “Your dreams will inspire my actions. Your concerns will guide my decisions,” ask him why he and his Government are determined to see that Singaporeans get to enjoy a smaller and smaller share of the pie their hard work has created. Ask him why consumption is so low and why the PAP is in such a hurry to boost the reserves and put them beyond reach of our ciitizens so that not even a modest amount of the interest on these gargantuan reserves can be used to alleviate the burdens Singaporeans face. Rather than the folksy, guitar playing persona LW’s publicists and his tame state media are working overtime to project, the real uncaring face of the PAP was amply demonstrated when the disgraced former speaker, Tan Chuan Jin, muttered “effing populists”, thinking his mike was not on. Every Singaporean should remember what the PAP really think of them when their turn comes to cast their vote at the upcoming election.

answer back