Another Week, Another Case of Money Laundering

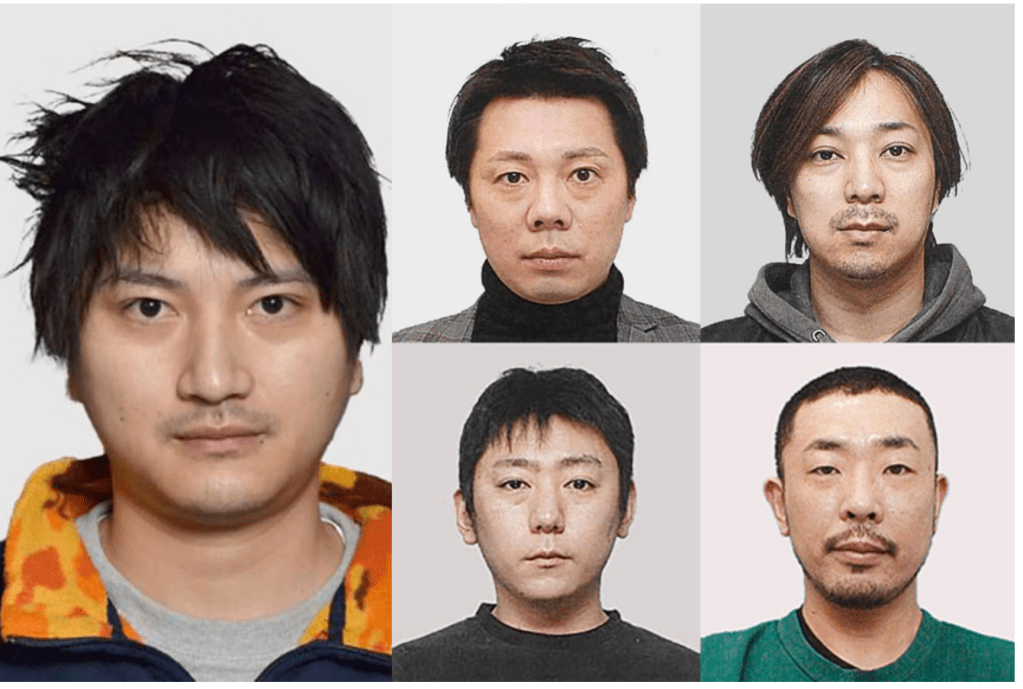

A few days ago the State Times carried yet another report about a money laundering syndicate, this time from Japan not China. The sums ($629 million) were smaller than the $3 billion figure placed on the money laundered by the former Chinese nationals, who had all acquired foreign citizenships, but they demonstrate that Singapore is still very much a favoured destination for money launderers. Despite being sought by the Japanese police and fleeing the country in February to avoid arrest, the leader was able to rent or buy a condo in Bukit Timah and register as a director of a local software company with the same name as the company under investigation in Japan. Two other syndicate members apparently resided in Singapore, either at condos or landed property and used the addresses in setting up local companies.

Their lawyer, a Japanese national who has become a Singaporean PR, is quoted as saying that he carried out all the due diligence checks he was required to and even flew to Japan twice to meet the principals. This seems unusual if it was not already a suspicious transaction. It would be good to know whether the Japanese police contacted the Singapore Police Force for help. When I suggested that in the case of the $3 billion money laundering, the SPF only acted to arrest the individuals involved when the Chinese foreign minister visited Singapore, I received a POFMA. The Government claimed the timing was purely coincidental. In this case the Singapore authorities seem to have been completely oblivious of the existence of this syndicate in our midst. The willingness of the PAP to allow foreign criminals to take up residence in Singapore provided they don’t commit any crimes locally has a long tradition since the 1980s when Indonesian corrupt officials parked billions in Singapore banks and the PAP Government refused to cooperate in the recovery of the funds. This continued with scandals like 1MDB when money laundering checks were subverted by corrupt employees of foreign financial institutions with branches in Singapore. Ultimately the blame must be laid at the door of MAS for lax supervision.

When LHL said that he would do anything to encourage more billionaires to move to Singapore it unfortunately seems to have been taken as a signal globally that Singapore would be relaxed about the sources of wealth. As I have stated in my previous blogs, a low tax regime and a relatively low bar to acquiring residence and even citizenship has helped to push up the prices of real assets, in particular landed properties like GCBs, to levels well beyond what Singaporeans can afford and indeed beyond any rational economic calculation of value. While the bulk of this appreciation has probably nothing to do with money laundering, launderers in particular are not concerned about whether the assets they purchase can generate a viable return since their money is worthless till it’s been cleaned. I am not alleging that there was anything untoward about the purchaser of Shanmugam’s Astrid Hill property or that the Minister has done anything illegal. However the price paid was dizzyingly high and the return over twenty years astounding. The fact that I have not been able to find details of the sale in the URA database though it occurred a year ago is puzzling. The names of the beneficiaries of the Jasmine Villa Settlement trust should be released to allay any suspicions, however unlikely.

answer back