One Index The PAP Would Rather Not Be Top Of Or Would It?

The PAP take credit for Singapore’s stellar performance in many global indices and engages in various strategies to boost our ranking, including comparing Singapore with large countries instead of cities, using inappropriate measurements and focusing on inputs rather than outcomes. I detailed some of these misleading measures in my last blog but one, State Media Attempt to Bamboozle Singaporeans Yet Again With Fake News.

The PAP take credit for Singapore’s stellar performance in many global indices and engages in various strategies to boost our ranking, including comparing Singapore with large countries instead of cities, using inappropriate measurements and focusing on inputs rather than outcomes. I detailed some of these misleading measures in my last blog but one, State Media Attempt to Bamboozle Singaporeans Yet Again With Fake News.

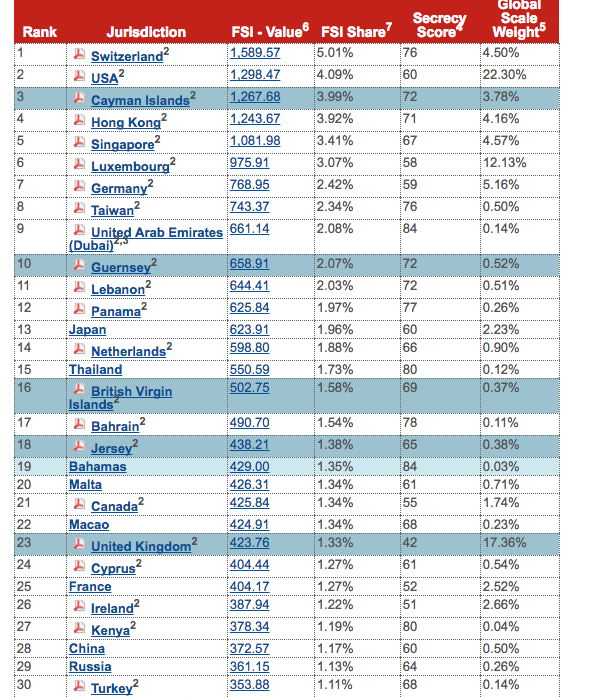

However recently Singapore again came near the top of an index that the Government is probably not so keen on. On 30 January 2018 the Tax Justice Network (TJN) announced the annual revision of its Financial Secrecy Index (FSI), which placed Singapore in fifth position, behind Switzerland, the USA, the Cayman Islands and Hong Kong.

A quick examination of the methodology revealed however that Singapore’s (and Hong Kong’s) position should probably be higher (for those interested in reading about the methodology you can find it here). The study’s authors first compute a Secrecy Score for each country. This is based on such factors as whether it is possible to find out who are the beneficial owners of limited liability companies and partnerships or of real estate and whether the country has a bonded warehouse (known as a freeport to use the correct terminology) where gold, precious stones, works of art and other valuables can be stored without declaring who owns them or paying taxes. Singapore scores 67 on this measure which is much higher than the US (at 60) but lower than Hong Kong (71) and a whole host of tax havens such as the Cayman Islands(72), British Virgin Islands(69), Panama(77), and the UAE(84). However Singapore is well ahead of the US which scores only 60.

So why does the US rank ahead of Singapore? The reason is that the TJN weight the Secrecy Score (SS) by using the country’s share of global financial services exports. Not surprisingly the US, with its far bigger economy, has a much bigger share of global financial services exports (22.3%) compared to Singapore (4.57%). The authors cube the SS and then multiply that by the cube root of the Global Scale Weight or GSW (the share of global financial services exports), measured between 0 and 1. This has the effect of raising the weight of countries with a smaller GSW but it still means the share of the US is nearly double that of Singapore. So despite having a markedly lower SS than Singapore, Hong Kong, and the Cayman Islands and around the same level as Germany (59) the USA comes in second in the Financial Secrecy Index. This suggests that TJN’s desire to paint the US as black as possible is getting in the way of exposing the real villains.

This is despite that TJN’s narrative report on Singapore quotes Morgan Stanley’s chief Asia economist Andy Xie who in 2006 questioned in an internal email that later became public why Singapore had been chosen to host the annual IMF and World Bank meetings:

[Delegates] “were competing with each other to praise Singapore as the success story of globalization . . . actually, Singapore‘s success came mostly from being the money laundering center for corrupt Indonesian businessmen and government officials . . . to sustain its economy, Singapore is building casinos to attract corruption money from China.”

It is not only Singapore whose role as a conduit for dirty money is downplayed. It is surprising to see Luxembourg come so far down the list with a SS of only 58. A more significant indicator of its status as a centre for tax avoidance and evasion is given by the fact that its GSW is 12.13%, or nearly three times that of Singapore and Hong Kong and more than half that of the US, despite being mostly rural with a population only about 10% of Singapore’s.

Not surprisingly there has largely been a deafening silence from our fearless state media about the issue of the 2018 index. It is even slightly surprising since one suspects that a reputation for secrecy and tax evasion is something the PAP Government wants to encourage if it helps to attract more accidental billionaires like Eduardo Savarin, who would have sold an embryonic Facebook for US$10 million if he could have overruled Mark Zuckerberg, or kleptocrats like Robert Mugabe. Thanks to the way the index is constructed, our Government can point to the fact that the US is ranked higher than Singapore as an excuse to do nothing while it continues to reap the benefits of being a centre for money laundering and tax evasion, as illustrated yet again by the recent 1MDB scandal.

answer back