Is Your CPF At Risk if Stock Markets Fall Any Further?

You can read my refutation of Chris Kuan here:

A few days ago I updated my very approximate calculations of how Temasek’s portfolio was likely to be performing since the commencement of the 2016 bear market using the geographical distribution of their portfolio as at 31st March 2015. You can read about it here. Of course using global stock indices as a proxy for Temasek’s performance may be wildly inaccurate since Temasek has undoubtedly invested in higher-beta and riskier investments than the market.

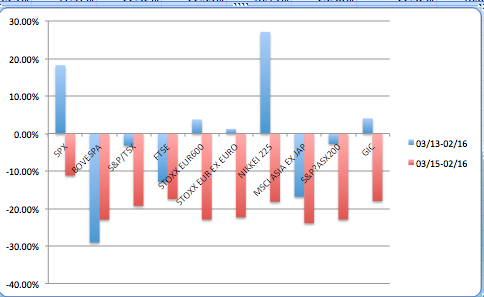

But for what its worth, I calculated that the value of Temasek’s portfolio had probably fallen at least 20% since the year ending March 2015. I have now updated it to bring the results up to date with the latest falls in global equity markets. As of yesterday’s close, before today’s fall in the Nikkei index and before the Chinese market reopens on Monday when it will catch up with and probably decline much further than the falls in other markets while the Chinese market was closed, my proxy for how Temasek is doing was down nearly 25%. This would take the equity value of its portfolio down to $166 billion from $218 billion (this is less than the headline figure for total assets because of the minority interests in the companies it controls, e.g. SingTel and SIA). See the graph below for a breakdown of the principal indices’s performance and a weighted calculation of how Temasek’s portfolio would have performed if it exactly matched the index.

Again I would like to stress that this is probably an under-estimate for how much Temasek’s portfolio has fallen. Its portfolio is heavily weighted towards financials particularly in China and these have fallen much more than the indices since the start of the year on worries that the whole banking sector will collapse under the weight of US$5 trillion in bad debts. The Global X China Financials ETF is now down over 35% from its level as at 31st March 2015. I do not know how currency movements have impacted the portfolio since I do not know how far Temasek hedge their exchange risk but the SGD has declined against the euro (positive) and appreciated against the Chinese yuan (negative).

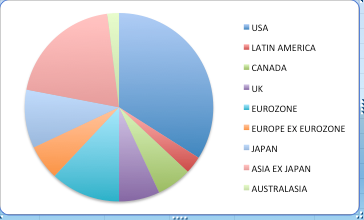

I decided to conduct a similar exercise for GIC, again using the performance of the main stock indices in the geographical breakdown for GIC’s investments given in the last annual report for 2015. GIC provides far less information than Temasek. However for what it is worth I calculated that on the equity portion of its portfolio, GIC could be down at least 18% since the close of its last financial year. See the similar graph below together with a pie chart showing the geographical breakdown of GIC’s portfolio.

Around 35% of GIC’s portfolio is invested in bonds and cash. Whether this has lost value depends on how much is invested in junk or high-yield bonds. While Government bonds, whether conventional or inflation-linked, are broadly unchanged to slightly higher over the past year, high-yield bonds have lost as much as 10% of their value. Without knowing more about the breakdown of their portfolio it is impossible to say whether GIC has made or lost money on its fixed income portfolio.

If we assume that the breakdown between equities and bonds does not differ between countries and also assume that as a best-case scenario GIC has not lost any money on its bond portfolio then the total value of its portfolio will be down over 12%

If however we assume that a much higher proportion of US assets were held in the form of Treasuries while the remainder of the portfolio had a much higher proportion of equities then GIC could theoretically lost even more than 18% since the US market has fallen much less than Asian or European markets.

How does this affect GIC’s ability to pay out CPF holders? The first point is that GIC does not have a direct relationship with CPF. CPF buys special securities issued by the Government which then on-lends the money to GIC (or Temasek or another Government entity like Changi Airport which on its own is probably worth at least $30 billion). So meeting the obligations to CPF holders would be the responsibility of the Government.

In my blog in entitled “Show Us The Money or the Funny World of PAP Accounting“, I calculated that if the Government’s Statement of Assets and Liabilities were correct then it was likely that GIC had lost substantial amounts of money if judged purely on its management of CPF monies. I reached that conclusion by this calculation which I have updated slightly:

Total assets are given as $834 billion as at 31 March 2013.

Firstly we can take off $169 billion for the shareholder equity in Temasek as at the same date.

This leaves $665 billion.

Next we can take off accumulated revenue from land sales. This amounts to $170 billion since 2006 alone. Let us say conservatively that the value of revenues from land sales amounts to $340 billion since 1980 including reinvestment income.

That would leave $325 billion.

Then we can subtract $75 billion for operating surpluses since 1989. That is assuming no reinvestment income from the surplus. Let us say $100 billion including interest.

Taking that away from total assets leaves us with $225 billion.

The problem is that according to the Statement the Government Securities Fund (which represents both Government market debt and the debt owing to CPF holders) is $401 billion.

Taking that away from $225 billion leaves a negative balance of $176 billion

If the Statement is correct GIC has lost about half the value of the CPF monies invested in it via the Government since it was set up in 1980.This flies in the face of its claims to have achieved a near 5% 20 year annualised real rate of return which would be considerably in excess of what it has had to pay to CPF holders.

This strongly suggests that GIC is actually getting a significantly negative return on the CPF monies it has borrowed. However since the Government is the borrower it can dip into the accumulated operating surplus as well as Temasek’s dividends to repay CPF holders. Constitutionally it is not supposed to touch the revenues from land sales or past reserves but it can and does get around this constitutional roadblock by giving the money to GIC (or Temasek). GIC can then use this money to repay the Singapore Government while the President, even if he is interested in acting as any kind of watchdog, is none the wiser.

This is a bad deal for Singaporean taxpayers and future generations since if GIC continues to lose money the reserve cushion over and above Government debt may be eroded particularly if the Government is no longer able to generate as much revenue from land sales and Temasek’s assets also decline.

I checked to see if both Temasek and GIC had lost money since the date of the last Statement of Assets and Liabilities on 31st March 2013. Using the same method as before my tracking portfolios indicated that Temasek is likely down as much as 3.5%, possibly much more, compared to 31st March 2013 but GIC could be ahead by as much as 4%. But since 2013 the total value of Government debt has risen to $411 billion. Additionally GIC has to meet the interest payments on the debt including the obligations to CPF holders. According to the Statistics Singapore website, the blended interest rate on all CPF deposits which were nearly $300 billion as at December 2015, is about 3.3%.

Ultimately there should be no reason to be immediately concerned that the Government will not be able to repay its CPF obligations. However my analysis strongly suggests that the system is at risk in the longer term as GIC appears to be losing significant amounts of money on its core business of managing your CPF savings. These strains explain why the PAP are going in the opposite direction from most advanced countries and ensuring that they lock up more and more of your CPF savings for longer and longer periods. And while the Finance Minister may claim that he is paying a generous rate of interest on your CPF the real rate of interest is much lower.

The serious losses that Temasek and GIC have suffered since the end of the last financial year will bring forward a potential negative equity situation for the Government, particularly if the falls in asset markets intensify. We may only be seeing the initial stages of a much more serious decline in the Chinese market and a potential recapitalisation and wiping out of the equity of the banks in which Temasek has so generously invested.

Of course Singaporeans will be kept in the dark and it is unlikely that any management heads will roll. However I would not bet against Tharman cutting CPF interest rates in the next Budget as well as the value of annuities from CPF Life.

Kenneth, would you be willing to stick your neck out and say whether we are in for a full blown recession globally? Apart from the fact that the Chinese market appears to have run out of steam, the drop in oil prices means oil producers such as Saudi Arabia who have been large spenders in the past are now running deficits (some such as Russia and Venezuela are, of course, under water). To what extent is this offset by gains in oil consumers such as India and Japan?

In Singapore, of course, state companies such as FELS and Keppel that have been thriving on labour-intensive rig building businesses have seen their markets – and businesses – collapse. For some of us, this is a good thing because it means fewer workers on our MRTs and busses. Are you able to say what effect this is likely to have on their balance sheets and whether, as a best guess, they are likely to need tax-payer bail-outs?

Singapore – and the PAP – (like big-brother China) might finally be coming to the end of their fairy-tale growth story.

LikeLiked by 1 person