Temasek’s Portfolio is Probably Down 20% Already and the Chinese Stock Market Rout May Just Be Getting Started

Back in July last year I did some rather basic analysis of Temasek’s results for the year ended 31 March 2015 and for the performance of its portfolio since then (see “Will Mrs Lee Get a Huge Bonus on the Back of Temasek’s Results?“). Then Temasek management were basking in the glory of having achieved a Total Shareholder Return of 19% which beat even their claimed return of 16% p.a*. since incorporation.

That 19% return was largely driven by the huge rise in the Chinese stock market. The Shanghai index rose over 80% in the year ended 31 March 2015. In fact comparing an average of stock index performance weighted by the share of stocks from that region in Temasek’s total portfolio, I concluded that far from outperforming the market Temasek management had in fact likely underperformed it by as much as 34%. And that was before factoring in the depreciation of the S$ against the US$ which would have given a favourable tailwind to Temasek’s results for the portions of its portfolio in the US and countries whose currencies had not depreciated such as China, which comprised a massive 27% of the total portfolio. I reproduce below the pie chart from my earlier article showing the geographical breakdown of Temasek’s portfolio.

Of course part of Temasek’s portfolio must be in cash or money market instruments though this is probably only a small percentage of the total portfolio. The 2015 annual report shows 34% of the portfolio in liquid or sub-20% listed assets but does not tell us how much of this is cash. Cash is probably significantly less than 10% of the total portfolio.

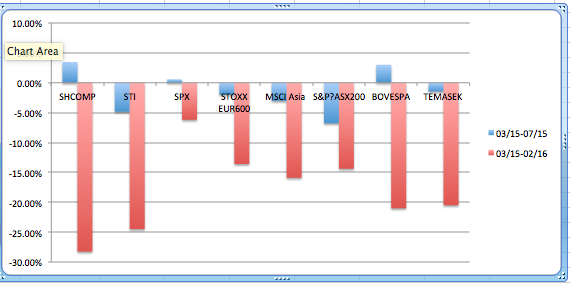

Repeating the exercise today with the new levels of global stock indices puts the value of Temasek’s portfolio down by over 20% (see graph below). If this were true it would take the total value over 5% below what it was in the year ending 31 March 2014! Assuming that unlisted assets (which comprised 33% of the portfolio in 2015 and have been growing rapidly) have not performed worse than stock indices than Temasek’s portfolio may now only be worth around $211 billion.

However many of the unlisted assets may have performed worse than the index or may even be worthless. One can probably assume that the entire equity value of Olam would be worthless without Temasek’s support. Similarly Temasek paid Li Ka-Shing US$5.7 billion for 25% of Watsons, a premium that HK retail investors balked at paying. With the slowdown in the Chinese economy that stake would likely have fallen in value by more than the fall in the Shanghai Composite or the Hang Seng Index.

Temasek is considerably overweight the banking sector in China. Using the FTSE China A 600 Index-Banks as a proxy for the value of Temasek’s stakes in Chinese banks this index has only fallen some 13% since 31 March 2015. So perhaps Temasek has done less badly than my crude analysis above suggests. However in the year to 31 March 2015 the FTSE Chinese Banks index rose 66%, suggesting that Temasek severely underperformed or else used part of the gains to cover losses elsewhere.

It also suggests that the potential downside to Temasek’s Chinese portfolio is much greater. Much of China’s recent expansion since the financial crisis of 2009 has been fuelled by Government-directed lending by Chinese banks to corporates to fund a reckless expansion of overcapacity. Chinese non-financial corporate debt reached 123% of GDP in 2015, up from 99% in 2009 while total debt to GDP rose to 236%. A lot of this investment in overcapacity will have to be written off together with the loans that go with it resulting in a possible wipe-out of many Chinese banks’ equity and state-directed recapitalisation. In any case Temasek is locked in for the ride since the Chinese Government is unlikely to allow it to sell its stakes.

While Temasek’s stakes are small relative to the total size of its portfolio, Temasek is also being battered by the drop in oil prices and the fall in value of its stakes in the oil rig builders, Keppel Corporation and Sembawang Marine. Both companies’ share prices are down by over 40% from where they were marked on 31 March 2015 and there has been speculation about emergency rights issues which indicates probable further downside for the stocks.

Temasek has been making a determined effort to sell out of its listed stakes and move more of its portfolio into unlisted assets, ostensibly chasing higher returns but also having the benefit of making the valuation of its portfolio more opaque and the prices of its unlisted assets easier to manipulate.

If I had time I would like to see the valuation of each of the major listed stakes today compared to its value on 31 March 2015. However that will have to be the subject of a later article. However we can safely conclude that Temasek’s portfolio today is worth at least 20% less than it was at the end of the last financial year and the situation looks likely to get a lot worse by the end of this financial year. But will we see that reflected in this year’s annual report? I would not bet on it.

*As I have frequently pointed out that 16% p.a. compounded return is highly questionable since it largely derives from the transfer of a significant portion of Temasek’s assets from the Ministry of Finance to Temasek at incorporation. This was done at a fraction of their true worth, particularly SingTel, which produced a huge book profit when it was revalued after being IPO’ed and listed in the early 1990s with Temasek retaining a majority stake.

it will be an increase in value if they report in Ringgit y’know?

LikeLiked by 1 person