Dear Lawrence Wong, Until You Provide Some Transparency Over the Reserves and the Surplus There’s No Reason to Believe Your Claims That the GST Hike Was Needed

Yesterday the PM defended the GST hikes in Parliament after Pritam Singh said they had “turbocharged” inflation. The GST hikes were generally quickly reflected in higher prices, given the oligopolistic structure of much of the retail industry in Singapore, particularly in essentials like food where the major players are PAP controlled NTUC Fairprice and Sheng Shiong, whose controlling family is also PAP linked. I have already done a brief comparison of prices for a range of essential foodstuffs like chicken, bread, rice and sugar and found that NTUC Fairprice is much more expensive than Tesco in the UK. So the GST hikes were a significant contributor to inflation in 2023 and 2024, when inflation was 4.8% and 2.4% respectively.

However one-off GST hikes are not likely by themselves to have resulted in continuing price rises. Singapore’s workers’ bargaining power is weak and the only trade union organisation permitted (NTUC) is under the PAP’s control. It doesn’t speak out against the way Government policies are designed to hold down real wages and increase profits and the surplus through employer friendly labour and immigration policies. It even argues against a minimum wage. So while workers may have received some compensation for the GST hike that was not paid for by productivity increases it would be unlikely to result in sustained cost push inflation of the kind seen in countries where high inflation expectations are embedded into the bargaining process.

More importantly the GST hikes were actually deflationary because they transfer money from households to the government. If spending increased by exactly the same amount as the tax increase then it would be neutral (depending on how much government spending leaked into imports) but as we all know the PAP’s raison d’etre is to save money to build up large reserves This is ostensibly for the benefit of future generations, but with the Total Fertility Rate seemingly permanently stuck below 1 the native population will halve every generation. Such unnecessary saving is just a transfer from Singaporeans to immigrants, none of whom have had to undergo extreme austerity.

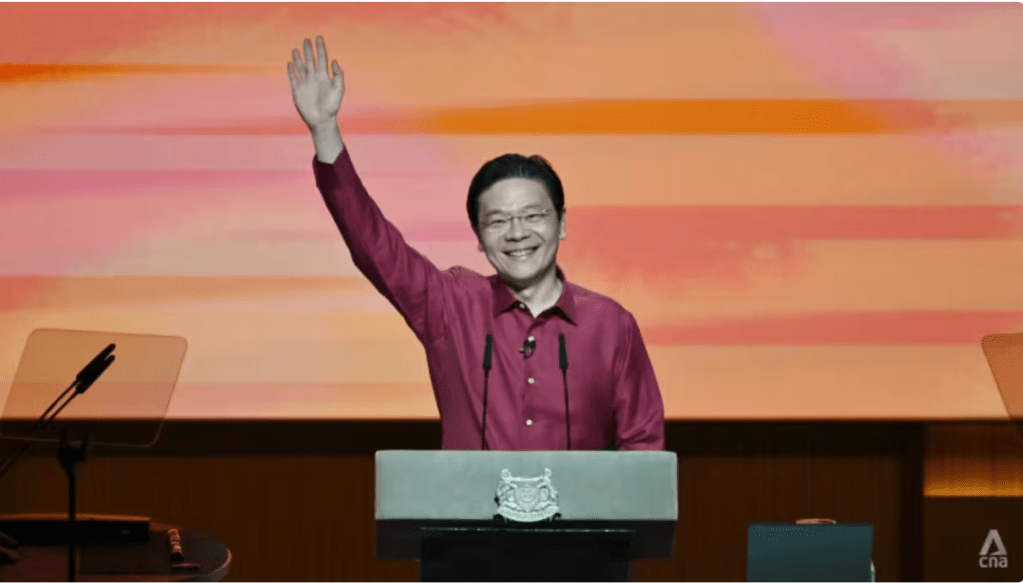

Lawrence Wong claimed that without the additional GST revenues and an unexpected surge in corporate tax collections, Singapore would have ended the last financial year on a deficit .

He went on to say, “The projected balance in FY2025 would also have been a deficit, and that would have meant less funding for essential services, less support for our seniors, and fewer resources to invest in our future. Basically, Singapore and Singaporeans would have ended up in a much weaker position,”

But that’s because of the exceptionally restrictive Budget framework, something I have written about for over ten years. This excludes revenue from land sales, even though money from the Budget is used to “subsidise” Singaporeans’ HDB purchases both directly and through grants to HDB, enabling it to buy land from SLA at very high, supposedly “market”, prices. It also excludes dividends and interest and investment income, which are shown in the Budget statement, as well as the retained earnings and capital gains from Temasek, GIC and MAS, which are not. There is the Net Investment Returns Contribution (NIRC) but almost all of that is put into long term funds and endowments which is not spending. It’s true that the Government also draws on the long term funds but this is usually substantially less than the amount going in. In 2024 the Government topped up the endowments and trust funds by $22 billion (out of a total NIRC of $24 billion) but only spent $15 billion in 2023. In many years before that it’s been much less. The best (though only partial) way of gauging the real size of the Government surplus is to look at the General Government Finance cash surplus. This is calculated using the IMF rules and thus a better measure of how much the Government is taking in versus expenditure. Over the last 20 years this has amounted to over $330 billion. Suspiciously the cash surplus has been much less over the last 3 years. This doesn’t square with the higher tax receipts and increasing revenues from land sales as well as what must be large market gains by the Sovereign Wealth Funds have enjoyed. This suggests that the Government is retaining more money in Temasek and GIC than previously or employing some other accounting subterfuge to disguise the real surplus.

Singaporeans shouldn’t be fooled by Wong’s assertions that he needs the additional revenues from GST. The Government’s fiscal position is already exceedingly comfortable even using the unnecessarily restrictive straitjacket that it has forced on us. The $13 billion surplus over the last 2 years on this basis is only the tip of the iceberg. I have calculated that based on the NIRC and the Statement of Assets and Liabilities that the Government has easily $3 trillion in net assets and probably over $4 trillion if we include the assets backing government debt. If we allowed additional spending of maybe 1% of this that would be another $40 billion. I would say that we could easily afford universal healthcare but we should already be able to afford it given the size of the healthcare budget which on a per capita basis for citizens and PRs works out to more than is spent by the NHS in the UK. As I have said many times, why aren’t the accounts of MOH Holdings presented to Parliament and why are the Government subsidies to the privatized healthcare companies only less than half of the $20 billion or so allocated to MOH? Even so MOH Holdings is hiding reserves of $8 or $9 billion.

Don’t be bamboozled. by fake claims that the Government has no money without being shown the full picture. Not only were the GST hikes unnecessary. GST and other value-added taxes are in Trump’s sights as being an unfair trade barrier but that’s anpther story. We can and should be spending a lot more on improving Singaporeans’s lives and alleviating the cost of living pressures that the PAP have imposed on us so that the can run bigger and bigger surpluses. Even as GDP has expanded massively through MNC tax arbitrage they have driven down consumption to an ever smaller proportion of that till it’s now well below 40%. Yet the PAP can’t explain what the surpluses are needed for since the native born population iis declining precipitously. Why should your wealth that your hard work has helped build up be transferred to new generations who have no previous connection to Singapore and have not undergone the senseless austerity? Unless you pluck up the courage to vote for people like me who will force the PAP to provide answers and open the books you will continue to sell yourselves short. It’s time to take back your rights as citizens of a free country. Take back what belongs to you!

answer back