Singapore is Reeling from the Latest Money Laundering Revelations

If you’ve been reading my blog you will know that Singapore’s blasé attitude towards abiding by legal norms and processes is a theme of mine. You may remember the Panama Papers. I said that there weren’t many revelations about Singapore (except those concerning a relative of the late LKY’s wife) because Singapore is its own Panama. Others thought that it confirmed Singapore’s squeaky clean reputation.

Let’s get some background to this. I think all my readers know that I’m an economist. A Double First from Cambridge and all that. But my working experience has ranged from global investment firms to my own boutique hedge fund. From junior newcomer to owner of my own firm, I’ve been obliged to fulfill Anti-Money Laundering (AML) regulation and extensive due diligence in order to be registered as a finance professional. But remember I was prevented from working in Singapore by Ng Kok Song and others so the training and due diligence I was used to was and overseas banking culture, not here in Singapore, and that’s important.

Let’s go right back to 1995 and the Nick Leeson scandal. For all of those who are the same age as my son and younger, you wouldn’t have been alive when this happened. I was a proprietary trader at Nomura at the time, heavily involved in the derivatives market. Nick Leeson was a derivatives trader whose fraudulent trades here in Singapore brought about the collapse of Barings Bank, Britain’s oldest merchant bank. Hundreds of thousands of words have been expended on this scandal including books and even a movie but it’s best summed up with a short Singlish phrase…see below

In brief Nick Leeson had tried to register as a finance professional in England but had been turned down because of prior credit card fraud. In a path trodden by many crooks subsequently he headed to Singapore where the regulatory system was lax and short-reaching. Barings had held a seat on Simex for quite some time and it activated the seat for Leeson when he was appointed General Manager. Furthermore Leeson ended up heading both front office and back office operations. This ludicrous situation could not have happened in any other major stock exchange other than Singapore because the job of the back office is to check the front office. In no other country is the front office role allowed to be filled by the same person as the back office role. I’m sure you have guessed by now what the Singlish phrase is that sums this up. It is a perfect example of “ownself check ownself”. It doesn’t make sense in financial governance or in parliamentary governance.

Lax regulation and a light touch will always encourage criminals. Leeson wasn’t the first to head this way to take advantage of our naivety or cupidity and he was by no means the last. We have seen the various arrests and prison sentences meted out to Singapore-based executives involved in the Wirecard scandal. When you add to that febrile mix banking secrecy and two of the dirtiest and most corrupt businesses known to the world, namely Casinos and F1, don’t expect clean money to follow the dirty.

Amazingly the same Singapore banks that were heavily fined in the 1MDB scandal were also sanctioned in the Wirecard criminality. This was the second time for DBS in which Temasek is the largest shareholder. I don’t have to remind Singaporeans about Temasek subsidiaries Keppel Offshore Marine and SembCorp Marine’s enthusiastic adoption of bribery as a way of winning business in Brazil. This has been brushed under the carpet like so many scandals in SIngapore, the individuals involved being let off with “stern” warnings, possibly because a trial would have brought more embarrassing revelations to light that would have implicated senior management figures in Temasek.

Bernie Ecclestone was found by a judge to have paid bribes over F1 in 2013/14. Yet it wasn’t until recently that we found out that Bernie Ecclestone will go on trial in the U.K. in November for hiding US$650 million in a Singapore bank to avoid paying tax in the U.K.

It’s staggering that institutions like the IMF choose to court Singapore. In 2006 Andy Xie, Morgan Stanley’s star economist on the Asia-Pacific region, quit his job suddenly after an internal email he had written was leaked. The email contained his disparaging observations on Lee Hsien Loong whom he called a “princeling “at the World Bank/IMF meeting in Singapore:

“I thought the questioners were competing with each other to praise Singapore as the success story of globalisation. These Western people didn’t know what they’re talking about. Actually Singapore’s success came mostly from being the money laundering centre for corrupt Indonesian businessmen and government officials. Indonesia has no money.* so Singapore isn’t doing well. To sustain its economy, Singapore is building casinos to attract corrupt money from China. ”

*according to Reuters in 2016 around $200 billion of Indonesian money has been squirreled away in Singapore to hide it from the tax authorities in Jakarta.

I too had my doubts about the IMF’s overly cosy relationship with Singapore. My doubt centred on what i viewed as Tharman’s over keenness to become Christine Lagarde’s darling by seemingly giving away our money without going through the proper process. I have seen some commentators expressing surprise that I blew the whistle on Ridoutgate but I have always been speaking truth to power. That was back in 2012. Unable to get an answer from Tharman, Christine Lagarde or President Tony Tan, I took the MOF to court. The Government won the first case. I decided to appeal but the Supreme Court ultimately denied me locus standii to stop any similar cases in the future. While my case against MOF was ongoing the Auditor General (AuG) found a second loan that had been made in exactly the same unconstitutional manner that I alleged for the IMF loan commitment. The AuG quietly made the Government take the loan back and get Presidential approval in the proper manner. In other words ownself check ownself had failed but KJ check AuG had been pretty efficient. At that time M Ravi had a similar victory where the PM’s ” ownself unfettered power over every serf” was curtailed and a ruling was made that it was not his right to decide whether SMCs should have by-elections. More recently I wrote to President Halimah Yaacob demanding an independent COI over Ridoutgate but like my earlier dealings with Tharmand and Tony Tan, I didn’t receive a reply.

Even though the Government makes the right noises about being committed as a financial centre to only banking tax-compliant and clean money we know this isn’t true because of the money Bernie Ecclestone has stashed here. These revelations in the last two days about money laundering are even more staggering in the length of time they’ve been going on and the sums involved. To date 105 properties and 50 luxury cars have been seized alongside the cash and virtual assets.

I wrote at the beginning about my experience with AML training. When I was very junior the training basically consisted of watching a video where you were instructed to snitch on any of your colleagues who seemed to suddenly be enjoying an elevated lifestyle such as owning high end watches, luxury cars and even yachts which could only have been acquired through ill-gotten gains. These outward signs of illicit wealth are so obvious that I’m now wondering whether Shanmugam and PM Lee should be forced to watch those old money laundering videos, Clockwork Orange style, with their eyelids propped open so they don’t miss anything.

The Brigadier General has made his views on billionaires very clear saying that if he could persuade ten more billionaires to move to Singapore, he would, even if that worsened income inequality. That, he said, was:

“because billionaires bring business, they will bring new opportunities, they will open new doors, they will create new jobs.”

What a pity that all the jobs they’re creating are in the laundry business. Lord POFMA of Ridout and many mansions on the other hand, observed that he’d been cut off while out driving one evening, first by the driver of a Ferrari, then by a Porsche. (The reporter didn’t ask him if this happened just on his own front drive or out on the main road.)

The truth is that these billionaires will only tighten the economic squeeze felt by middle class Singaporeans. Each of those 105 mansions and each of those 50 cars is also tightening the squeeze. Interestingly the Gini coefficient in Singapore is not a good measure of inequality because it’s measured by household and the Government excludes households with foreigners in them. A much better measure is the share of luxury cars in the total car population. Luxury cars are defined as Aston Martin, Bentley, Ferrari, Lamborghini, McLaren and Rolls Royce – basically any car that has cut Shanmugam off and made him feel poor. The share of these cars has dramatically increased since 2005, each one taking up a COE.

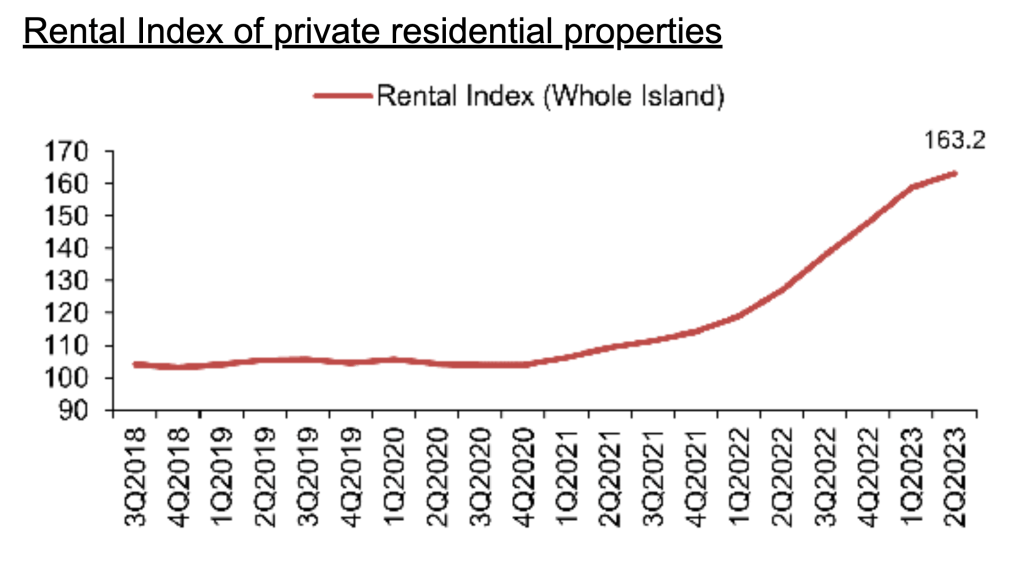

Whilst the lowest earners are getting poorer because we have no minimum wage and the middle classes are being squeezed by dirty money assets, at least Balakrishnan and Shanmugam can comfort themselves with the thought that their rents weren’t similarly squeezed. Balakrishnan’s rent was reviewed in October 2022 as part of his nine year lease agreement (reviewable every three years) which we have never been shown . Similarly Shanmugam’s rent was allegedly reviewed in June 2021 as part of a regular 3 year review of his 9 year lease. Shanmugam got the same rent locked-in at a time when private sector rents were rising fast. Vivian’s got a slight increase (about 5% ) at a time when we were all suffering from the squeeze and the private rental affordability index shot up.

As you can see from the long history of money laundering and dirty business in Singapore and the warm welcome to Billionaires, the notion of “ownself check ownself” is patently absurd.

Much respect for you sir. Greatly appreciate your fact filled articles that reveal information that SGP’s mass media never utter a squeak and totally sweep under a very thick carpet. Thank you for your courage and great intellect. Best wishes.

LikeLike

A well-written article by your pen, This should go into the Govt thinking heads. Finally, the Ridout saga appears not to be a true story, the 2 ministers are a trial project for who knows Ridout property might be leased out for PM and other heads’ retirement plans. the pretext of DPM giving approval is suspected to be not truth. One will wonder why no COI by independent com.

LikeLike