Debunking the Brexiters’ Dreams of “Singapore-On-Thames”

Hardly a day goes by without a tweet or sound-bite from a UK Tory politician, businessman or right-wing commentator (Daniel Hannam, Jacob Rees-Mogg and James Dyson, to name just a few) claiming that all the UK needs to do is turn itself into Singapore-upon-Thames to emulate its economic success. Martin Wolf, a veteran economics journalist from the Financial Times, wrote an excellent article but even so mamages to make basic mistakes preventing a like for like comparison by omitting key factors and gives far to much deference to the superiority of authoritarianism.

These first fundamental error he makes is to compare Singapore’s GDP per capita at purchasing-power-parity with that of the UK as a measure of its success. A more appropriate comparison would be with London since Singapore is a relatively small city by global standards and 100% urbanised. Also PPP is a difficult measure giv According to Eurostat, the GDP per capita at current prices of Inner London West was Euros 213,000 (US$236,000 at the prevailing exchange rate) and that of London as a whole was Euros 67,500 (about US$75,000) in 2015. In 2015 Singapore’s GDP per capita at constant prices was US$55,000.

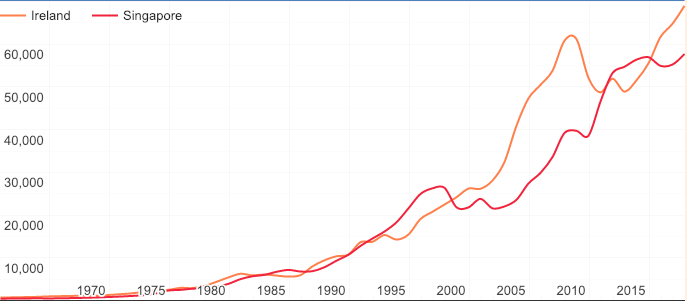

Even if we forget the city comparisons and only use country ones then the closest national comparison is with Ireland. Ireland has about the same size population and pursues similar policies of low tax rates (though only for corporations; Ireland’s highest personal tax rate at 40% is close to twice that of Singapore’s) and openness to foreign investment. Both countries use low tax rates to encourage MNCs to move their HQs and intellectual property and book their revenues and profits locally, thus artificially inflating their GDP per capita way beyond what the average standard of living in those countries would suggest.

For instance Dublin ranks 14th in UBS’s survey of Prices and Earnings in Global Cities 2018 on real net hourly pay while the three biggest US cities and many European ones are much higher (London ranks in 25th place). Singapore was included in the first survey 2011 but the comparison was so unfavourable, putting Singaporeans workers on a par with those in Kuala Lumpur or Moscow, that the Singapore Government clearly put pressure on UBS, through its sovereign wealth funds GIC and Temasek, to drop Singapore from subsequent surveys.

Singapore’s relatively high GDP per capita is also inflated by the fact that the ratio of the employed workforce to total population is much higher than average due to the large numbers of guest workers without dependents (who get sent home the minute they lose their jobs) as well as the longest working hours in the developed world. Looking at GDP per hour worked as calculated by the US Conference Board puts Singapore well below the US and below many of the major European economies (France, Germany, the Netherlands, Scandinavia though not the UK)

The Irish example provides an easy refutation of the argument that the UK needs to leave the EU to emulate the Singapore model. And it also refutes Martin Wolf’s uncritical acceptance of the benefits of authoritarian rule:

Singapore has probably grown no faster than most major global cities and has the advantage of a far superior strategic location than Ireland. In fact Brookings Global Metro Monitor 2018 put Singapore at 204th out of 300 of the leading global cities for economic performance for 2014-2016. Dublin ranked as No. 1 on the list.

Wolf says a complementary explanation for Singapore’s rapid growth is its high investment and savings rate, particularly its government surplus and the CPF forced savings fund. His figure for the government surplus is far too low since it excludes the surpluses generated by the sovereign wealth funds and other government entities. The true surplus as a percentage of GDP could be almost double that but the truth is that nobody knows since the Government ensures that information is kept secret, including the true size of the reserves which should certainly include an estimate of the value of the 80% or so of the land that it owns.

To suggest the UK should try to save over 40% of its GDP is patently absurd as the Government would immediately plunge the economy into a deep depression. The reason Singapore is able to do so is because it runs a corresponding surplus of around 10% of GDP on its current account which offsets the high savings rate. For the UK to generate such a large current account surplus would require levels of austerity that have not been experienced even in the Thatcher years. Adoption of similar mercantilist policies would be immediately attacked by the US just as it attacks China, Germany, South Korea and Japan for doing the same thing. Singapore gets away with it because its economy is much smaller and it takes care to run a trade deficit with the US by purchasing large quantities of the most expensive American armaments.

The reason Singapore’s growth rate has historically been so high is not because of any productivity miracle brought about by high investment rates. Productivity growth has been mediocre for most of the last twenty years and below countries like the US which invest less than half as much as a proportion of GDP. The reason is left unstated by Brexiters but is due to the fact that until very recently it was very easy for employers to bring in cheap labour from much poorer Asian countries. In the absence of a minimum wage and other labour protections that UK workers take for granted, this has depressed wages for unskilled labour well below those in the UK and below what they used to be historically in Singapore. Foreign labour now constitutes almost 50% of the workforce. The people who voted for Brexit did so in part because of the influx of cheaper labour from Eastern Europe which they believed had depressed wages. Yet the amounts of immigration from Eastern Europe into the UK have been much smaller as a proportion of the total UK population than the influx of foreign workers in Singapore has been of the Singapore population which has doubled in twenty years. Coupled with the fact that Singaporeans are only really free to invest their CPF savings in property (which for 90% of the population the only option is overpriced and leasehold public housing) this has driven up property prices, enriched the Government as the biggest property owner and monopoly housebuilder but lift Singaporeans overpaying for a depreciating asset.

Wolf is right to say that Singapore is not a realistic model for post-Brexit Britain but he is wrong to suggest that the model has desirable features that Britain should seek to emulate. And in the process he comes uncomfortably close to being an enthusiastic supporter of totalitarianism. There is nothing “complex and nuanced” about dictatorship.

answer back