Bombshell! Heng Confirms What I’ve Always Suspected: The Government Is Hiding Most of the Reserves from Singaporeans

In his interview with CNA on Wednesday Finance Minister and Seatwarmer-in-Waiting Heng said that Singapore’s financial position will be “a lot weaker in the coming years.” In my last blog I said I would examine the truth of this claim and what its implications are particularly for taxation.

Firstly is there any truth to his assertion that the Government’s financial position will be much weaker? In his Fortitude Budget statement, Heng says that the Government’s overall budget deficit will increase to $74.3 billion. However, just as in every Budget I have analysed going back seven or eight years, the Finance Minister counts contributions to endowments and trust funds in the Budget as actual spending when the money is not spent for several years if at all. For instance the Pioneer Generation Fund, for which former Finance Minister Tharman set aside $8 billion in 2014, still stands at $7.1 billion six years later, which obviously means that average spending has only been about $150 million p.a.

I have criticised this as fraudulent accounting in numerous blogs over the past eight years or so. In “Sherlock Holmes and the Case of the Missing (or Merely Hidden) Reserves” written eight years ago now I said “that the level of net assets is far too low given the operational surpluses, the claimed rates of return for both Temasek and GIC and the likely revenues from land sales” f

By “net assets” I was talking about the figure given in the Statement of Assets and Liabilities, that the Government is obliged under the Constitution to publish with the Budget every year, for total assets minus the Government Securities Fund (which represents the monies it has borrowed from CPF holders) and the Pension Fund (is this $12 billion all civil servants in which case it seems too low or is it just PAP Ministers and the PM’s family?). If we look at the current Statement of Assets and Liabilities (SAL) for 31 March 2019, more than a year out of date, then net assets are $557 billion. I reproduce below the current Statement:

However since 1990 the Government’s total surplus has been much more than this. In fact in my blog posts “Where have our reserves gone” and “Chesapeake Energy and Temasek: A Tale of Two CEOs and Shareholder Democracy”, both written in 2012, I said:

Recently I wrote an open letter to the Finance Minister asking him to explain some apparent discrepancies between the government’s annual Statement of Assets and Liabilities (ALS) and the reported general government surpluses. Using the IMF’s own figures as well as those kindly provided (after much prodding, to be explained in a separate post) by the Department of Statistics, I pointed out in my letter that the total reported surpluses are of the order of S$429 billion since 1980. This contrasts with my calculations from the ALS which show that real net assets (excluding land) are only some S$280 billion as of 31st March 2011.

While there I was talking about the period 1980-2010 the general government surpluses for the years 1980-1989 (I have to use the Statistics Singapore data since the IMF data only start from 1990) only amount to $14 billion. If we accept the IMF restatement as definitive rather than the Statistics Singapore figures then total surpluses between 1980 and 2010 are at least $443 billion.

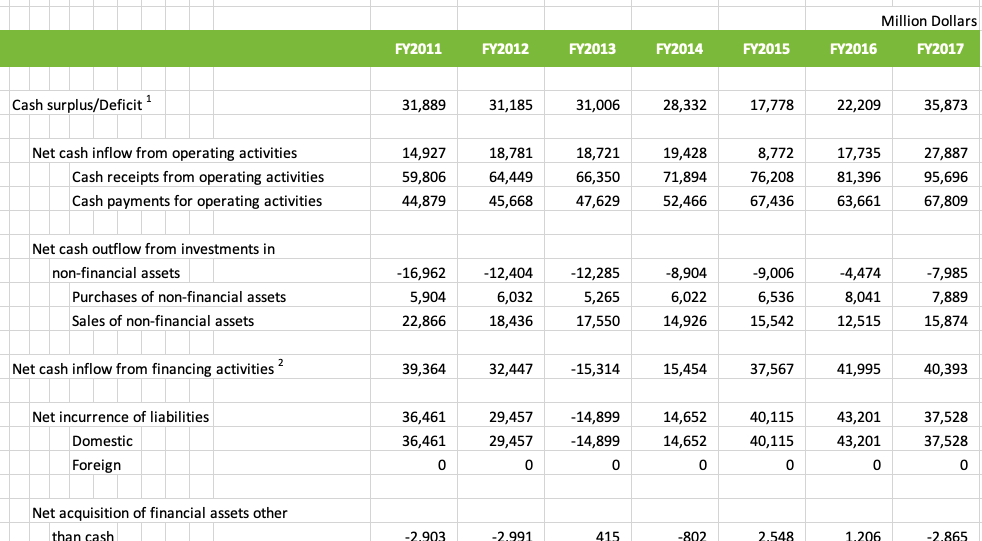

Over the period 2011-17 the Government’s cash surplus has been at least $198 billion while investment and interest income and income from land sales in 2018 was at least $29 billion. Adding this to the figure for total surpluses between 1980 and 2010 and for 2011-2017 gives a figure of $670 billion which is $118 billion than the net assets total shown in the the SAL. Even this is likely far less than the real surplus since it only includes cash dividends paid to the Government and not income retained within Temasek, MAS, GIC, Changi Airport Group and the Government’s myriad other private companies. At the same time expenditure that should be paid for by these corporate entities is often funded by the Government out of operating revenues. An example is the $5 billion that was set aside by Heng a couple of years ago to fund Changi Airport’s Terminal 5. Furthermore the figure for surpluses does not include the huge valuation gains on the assets owned by Temasek and GIC over the last forty years.

As I said in my blog “Sherlock Holmes and the Case of the Missing Reserves” there are only two conclusions:

- The SAL is a fraudulent misrepresentation of the Government’s true financial position since it likely excludes assets held by Temasek, MAS and GIC and the value of the other corporate entities that are held outside these groups such as Changi Airport Group. This conclusion is supported by the fact that in the latest Fortitude Budget Heng says he is allocating $13 billion to the Contingency Fund. Clearly that money is coming from a pool of assets that the Government is not disclosing in the SAL. That means there could be anything from $500 billion to $1 trillion, possibly more, in assets that the Government is hiding from Singaporeans while pleading poverty. Of course if we properly include the value of land the figure is probably about $3 trillion.

- The Government has squandered or mismanaged these huge surpluses produced by its ownership of most of the economy and 90% of the land so badly that a large proportion have been lost. In my 2012 blogs I attempted to calculate the rate of return consistent with such a low level of Government assets shown in the SAL and came to the conclusion that it was very low, certainly much much lower than Temasek’s claims of a compounded 17% p.a return or GIC’s claims of earning 3.4% above the rate of inflation over 20 years, itself a very poor return.

There is a third extreme scenario which is that considerable sums of money have been siphoned off but while a few billions or even tens of billions could disappear with an errant keystroke (or be allocated for salaries and bonuses for key personnel and validated by the people involved on the principle of if you scratch my back I will scratch yours) it is unlikely that hundreds of billions could disappear.

Despite the absence of any information and the Government’s deliberate stonewalling of my attempts to find out dating back eight years now, we can nevertheless safely conclude that Heng’s claims that Singapore’s financial position will be much weaker in coming years is pure fake news and he should receive a Correction Notice from the POFMA office. Clearly he is signalling that he intends to hike regressive taxes like GST far beyond the already indicated 9%! The Government has not provided even the same level of support to Singaporeans as in many other countries with much weaker fiscal positions like the UK and the US. To say it will be much poorer in coming years is like saying that it will go down from Jeff Bezos’s level of wealth to merely that of Bill Gates or Mark Zuckerberg. We need a proper accounting from the Government of the true value of all the assets it owns and we will only achieve that when Singaporeans elect at least one-third of MPs from the Opposition (and real Opposition not the fake Workers Party who believe they are in a cosy coalition with the PAP!). I strongly believe that the Government can spend $40-$50 billion more than it does on providing Singaporeans with universal health care and income support without reducing the level of its assets, only reducing their rate of growth. I challenge Lee Hsien Loong to provide the true figures to prove that this is not the case.

Buy Me A Cup of Coffee (or More)

If you believe in transparency and accountability and are interested in holding the PAP Government to account then help to support me to do so. I will continue to ask the hard questions that others will not.

S$1.00

Hi Kenneth, I would like to donate. But both paypal and visa failed, on both mobile and desktop browser.

You might want to ask your website developer to look at the payment gateway integration.

LikeLike

Thank you for the feedback. I have made WordPress aware of the problem and am waiting for them to fix it

LikeLike

Very informative, thank you

LikeLike

Your website is not allowing me to donate through my amex

LikeLike

You should be able to through PayPal thanks

LikeLike

Hi! Kenneth, you are absolute with all the facts, and pls kindly post more towards the GE.

LikeLike