More on Singapore’s Fake GDP Growth

As anyone who has studied Singapore for any length of time, as I have, much of what passes for statistics in Singapore is fake or manipulated to present a picture that flatters our rulers and allows them to be held up as poster boys for authoritarianism and the benefits of dynastic rule. While the overwhelming majority of authoritarian states drown in a malarial swamp of corruption and mismanagement Singapore is the shining exception, or at least was till China started being touted as likely to overtake the US.

As anyone who has studied Singapore for any length of time, as I have, much of what passes for statistics in Singapore is fake or manipulated to present a picture that flatters our rulers and allows them to be held up as poster boys for authoritarianism and the benefits of dynastic rule. While the overwhelming majority of authoritarian states drown in a malarial swamp of corruption and mismanagement Singapore is the shining exception, or at least was till China started being touted as likely to overtake the US.

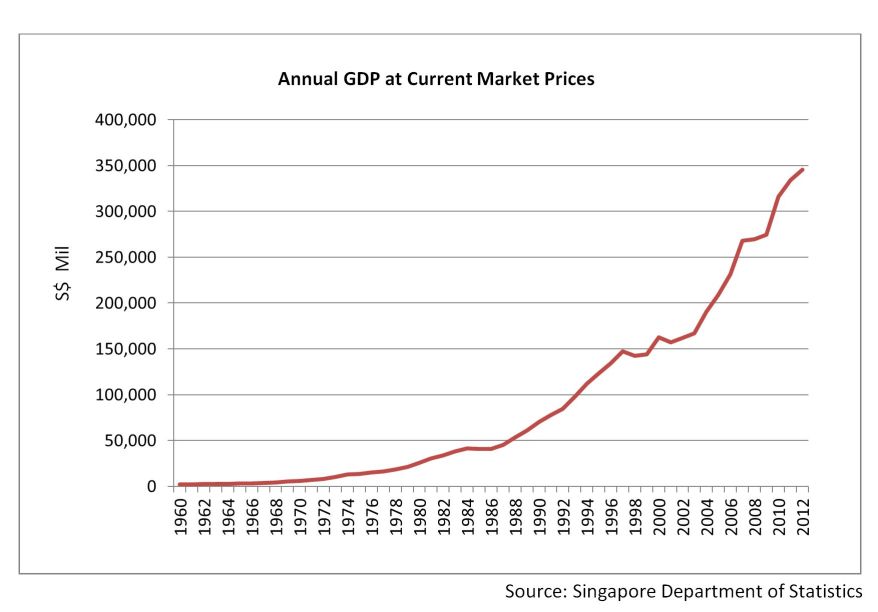

Most often cited is Singapore’s GDP per capita which is one of the world’s highest, only bettered by Norway, Luxembourg and a handful of small oil-producing states like Qatar. I have often pointed out that this GDP per capita figure is fairly meaningless and manipulated as Singapore has a very high proportion of foreign workers with few dependents so the employed labour force to GDP ratio is higher than in most countries. Additionally Singapore workers work some of the longest hours in the world, about 30% more than US workers and 50% more than Germans. When you normalise GDP per capita by hours worked to get a measure of productivity Singapore’s achievement is not that great at all. Our GDP per hour worked in 2015 was about the same level as Japan’s and only about 60% of the US level. The countries at the top of the list were Norway, because of its oil wealth, but also Luxembourg and Ireland.

Which brings me to the main point of this article. I have written before about how Ireland’s GDP is artificially boosted by its low tax rate. MNCs, particularly US ones, set up subsidiaries to hold intellectual property and other licences to transfer income out of high tax areas like the US and into low tax countries. Paul Krugman rightly called Ireland’s 25% GDP growth in 2015 “leprechaun economics.” I have said that a lot of Singapore’s growth is driven by the same tax-minimising strategies and cited Broadcom’s decision to redomicile to the US in advance of Trump’s cut in the US corporate tax rate to 20% as an example of how that strategy would lose a lot of its attractiveness.

A few days ago the Financial Times carried an article entitled “What the foreign direct investment data tell us about corporate tax avoidance” which confirmed Singapore’s major role as a tax haven for US corporations. The article says that since 1982 US corporations have spent about $5.1 trillion accumulating direct investments abroad:

“About $2 trillion of this growth has come from reinvesting profits “earned” in seven small countries known for helping multinationals avoid tax: Bermuda, the UK Caribbean islands, Ireland, Luxembourg, the Netherlands, Singapore, and Switzerland…

The net effect is that just over half of America’s foreign direct investment assets are now held in these seven corporate tax havens, up from a fifth as recently as the mid-1990s”

Investments in the seven tax havens are consistently more profitable than investments elsewhere, earning an implied yield of 9%, 3% more than investments elsewhere.

This surprising result is probably due to the fact that, as the article says, “haven-based subsidiaries of American companies overcharge their corporate parents for access to patents and other intangible inputs. By reducing exports and increasing imports, this would exaggerate the size of America’s trade deficit.”

Of course it would have the opposite effect for Singapore of increasing exports and reducing imports. Our net exports of goods and services amount to about 26% of GDP while our current account balance (which subtracts net income due to foreign entities and transfers) is about 19% of GDP.

According to Matthew Klein, the FT journalist, the majority of America’s Foreign Direct Investment income is now earned from seven corporate tax havens, US$254 billion out of total income of US$410 billion in 2016. If Singapore derived income accounted for one-seventh of this then about US$36 billion or 12% of GDP could be accounted for merely by tax avoidance strategies of US multinationals. Our Gross National Income (GNI), which measures GDP plus net income received from abroad, is lower than GDP by over 5% but this is unlikely to be the full story since American corporations reinvest their tax haven derived income rather than repatriate it where it would be taxed at the US corporate tax rate of 35%.

So when we read last Wednesday that Singapore’s GDP grew by 8.8% on a quarter-on-quarter annualised rate and was 5.2% higher than a year earlier we should rightly be sceptical. The PAP have gone out of their way to create artificial GDP growth by tailoring Singapore’s corporate tax rates to the tax avoidance strategies of US and other foreign MNCs. While our headline corporate tax rate is much higher than Ireland’s, concessions for companies establishing regional HQs in Singapore reduce it to as little as 5%.

Our impressive GDP and GDP per capita has little to do with the welfare of Singaporeans, whose living standards according to a 2011 UBS survey are little different from workers in KL. If and when the Trump tax cuts are passed, much of the incentive for reinvesting income in Singapore for American corporations will disappear and the PAP will find it harder to generate the kind of GDP growth figures that amaze gullible Western journalists.

Greeat blog

LikeLike

I just don’t see the growth, surely growth would lead to increased in demands for housing and other material goods…yet the house prices are dropping, sales are slowing, orchard road is dead….foreign companies are leaving….maybe I see it wrong?

LikeLike

Kenneth

Now that Congress has passed the tax cut bill and has lowered the corporatec tax to 20% how will this accect Singapore?

I see a fast hollowing out that the government won’t be able to adequately explain

LikeLike

Kenneth, talking about Singapore’s GDP per capita, I think you might have made the point previously that much of the wealth in Singapore is generated and sequestered by government-linked companies, so actual per capita income in the private sector is much lower than the headline figure.

I take it it is not possible to break out figures for GDP generated by GLCs and the rest? Like in many other areas to do with statistics in Singapore, we are shadow boxing here.

LikeLiked by 1 person

One has to use an educated guess to figure out the GLC contribution to GDP. A proxy will be useful such as % of employees vis-a-vis total workforce. Giving the GLCs monopolise transport, telecom, utilities, real estate, construction, etc. that would be around 40% to 60% of GDP, imho.

KJ used a similar rule to work out the USA FDI component of GDP one-seventh for 2016 at 12%. That is best case scenario as we could be easily beneficiary to one-fifth of the investments if not one quarter.

LikeLiked by 1 person

Narag’s assumptions sound reasonable. Workers in GLCs may be more productive than workers in the private sector as they tend to be in more capital intensive industries so the share could be larger than their share in the total workforce.

LikeLike