NOL: Another Case of Value Destruction by Our Natural Aristocracy

CMA CGM, a major global shipping company based in France, today announced that it had agreed to acquire Temasek’s 67% stake in NOL at a price of S$1.30 per share. As required under the Singapore Takeover Code an offer to the minority shareholders will follow once antitrust approvals are obtained. Since the two companies together constitute only slightly over 11% of global trade volumes this is unlikely to be a problem though the Chinese competition authorities may possibly use their approval as leverage to try and gain some competitive advantage for their state-owned shipping companies.

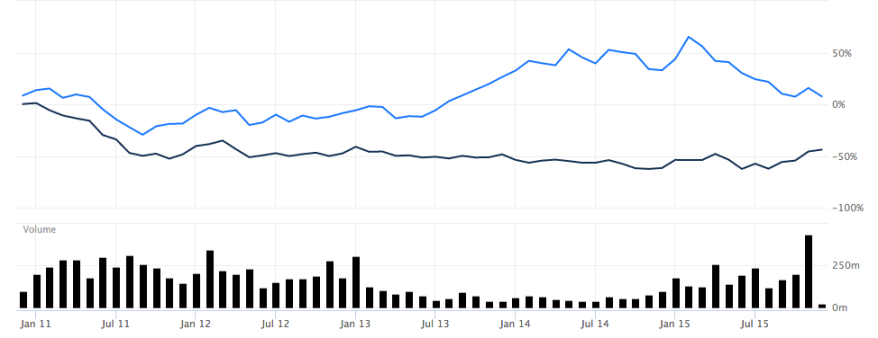

At first glance the deal looks like a good one for Temasek since the sale price is a 33% premium to NOL’s weighted average share price over the three months to July 2015 and a 49% premium to the last traded price before news that Temasek was in talks to sell its stake first broke at the beginning of November. The total equity consideration is around $3.4 billion.

However this ignores the fact that if Temasek had sold its stake in 2007, when the stock was trading above $5 per share, it could have achieved roughly four times the price it is achieving today. Even if it had sold in 2011 it could have achieved at least twice the price it is getting today. Since 2011 NOL has paid no dividends. Even the money from NOL’s sale of its logistics arm to Kintetsu World Express, about $1.2 billion, will be included in the purchase price so shareholders will not benefit.

Looking at the latest results for the third quarter of 2015 it is pretty clear that this is pretty much a forced sale. NOL has lost money every year for the past four. Without support from Temasek it is unlikely that NOL would have been able to continue as a going concern for much longer. Debt has been slashed but only through the sale of profitable assets and the reduction of cash to very low levels. Valuing its shipping assets to market would probably wipe out its equity and breach its banking covenants.

Why did the management of NOL and Temasek not sell the company earlier before the outlook for global trade and thus the global shipping industry deteriorated so sharply? Given NOL’s small size relative to the global giants like Maersk, Mediterranean Shipping Company and CMA CMG, selling NOL when the shipping market was considerably more buoyant (to use an awful pun) should have been a no-brainer even with allowance for hindsight. In fact I have been calling for the sale of many of Temasek’s stakes in major local companies since 2009 as part of the process of getting the state out of running companies and/or the listing of Temasek and the distribution of shares to Singaporean citizens.

We should have expected a better performance from the management of NOL, the list of which reads like a dream team of Lee Hsien Loong’s natural aristocracy and those who by their superior genetic heritage are predestined to rule over us. The Chairman of NOL is Kwa Chong Seng, LHL’s cousin while the CEO is the former head of the SAF, Ng Yat Chung, a Cambridge scholar. His deputy is the MP for Pioneer Cedric Foo. Also on the board is Alvin Yeo the former MP for CCK GRC who has proven an expert at maximising his own value, notably by grossly overcharging for his costs in the Singapore Medical Association’s action against Dr Susan Lim. I wrote about him here.

Of course in any other country this would be called cronyism but in Singapore, a looking-glass land of unicorns, this is meritocracy.

We would have got a better result if Temasek and NOL were run by value-maximising American style management. Unfortunately Temasek is a sovereign wealth fund and has little interest in maximising returns for Singaporeans. And to be fair Singaporeans have clearly demonstrated through their votes at the recent GE that they have no interest in providing any kind of spur to the management of state-0wned firms to improve their performance.

I include below a graph of the relative performance of Maersk’s, the industry leader’s, share price (in blue) compared to NOL, to demonstrate how badly NOL has underperformed. The recent closing of the gap is only due to the emergence of the announcement by Temasek and NOL that they were in discussions to sell the company.

Many of Singapore’s Linked Companies are losing money as there are run by many ex-general who learn to fight at the computer room and get their ranks of General. When a country wants to use SINS money to run it country with Gambling as the main income from Casinos, it will have to lost somewhere else to repaid for the SINS by it PM. Our PM are paying for his sins with a relapse cancel and the latest Postage Cancel. It is the will of the SKY that you sinned you pay for it.

LikeLiked by 2 people