Why Do the Greeks Resoundingly Reject Austerity Yet Singaporeans Embrace It?

On Sunday Greece’s voters overwhelmingly rejected the latest terms offered to them by their Eurozone creditors for rescheduling their huge debt mountain.

On Sunday Greece’s voters overwhelmingly rejected the latest terms offered to them by their Eurozone creditors for rescheduling their huge debt mountain.

With Greece’s debt to GDP ratio at 170% cutting spending and raising taxes to create a higher government surplus to pay interest and principal on debt is a vicious circle. As every Keynesian knows, and Krugman explains in some back of the envelope calculations in the NY Times (“Austerity Arithmetic“), cutting spending and raising taxes reduces output so tax receipts would fall. At the same time, as every monetarist knows, increasing the level of unemployed resources in the economy reduces inflation and increases the real value of debt. So slashing spending to reduce debt actually raises the level of debt to GDP and becomes self-defeating.

Of course in the longer term falling wages and prices will boost exports which will offset the drag to GDP coming from the higher Government surplus. But this is unlikely to work sufficiently fast to stabilise GDP and start reducing the debt to GDP ration in the short or even the medium term.

Having seen GDP fall by over 25% since austerity was imposed and unemployment at similar levels the Greeks have come to the blindingly obvious conclusion that further austerity to pay down debt is not going to work.

In the absence of a better offer from the Eurozone Governments, which means from the Germans, Greece is likely to have to go its own way and introduce a separate currency. It will likely demand an almost complete write-off of its existing debt. This includes the $21 billion or so it owes the IMF. If Greece gets away with it Portugal and Spain cannot be far behind, and after them, Italy. All the Southern European economies have experienced big falls in GDP, high unemployment and a widening output gap.

If Singapore’s US$4 billion loan commitment to the IMF is called as a result of the Greece’s decision to stop paying off its debt, then it will be interesting to see how the Finance Minister and the Government can justify their decision not to seek Parliamentary approval for this contingent liability to the IMF. Tharman and the AG both claimed that lending to the IMF carried no or negligible risks.

I wrote about this a few days ago here. If I were in Parliament I would be pressing the Government to make provision for a substantial proportion of its lending to the IMF on the grounds that they may never get repayment without extending substantial new loans to the IMF, particularly if the Southern European countries and other debtor nations follow the Greek example. In other words using our money to pay us back.

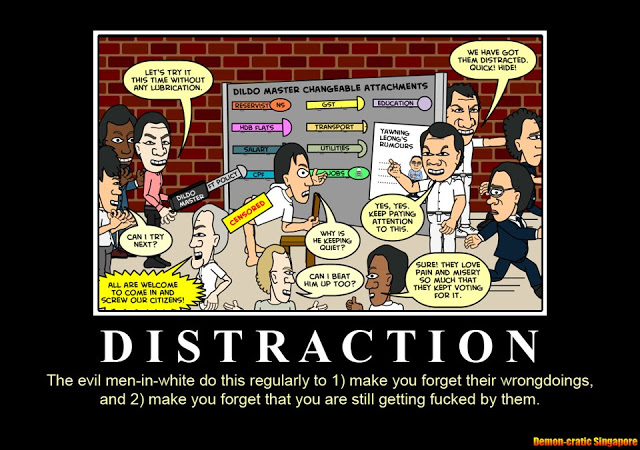

This illustrates how the PAP Government has an almost unfettered freedom to give away our assets accumulated through years of austerity that the Greeks have refused to endure.

It also shows ultimately how worthless it is for the Government to continue to accumulate claims on the rest of the world by running huge surpluses. At some point all the assets accumulated could become worthless if countries whose debt we hold decide to stop paying back the debt. In that case what would we have gained by going for decades without old age pensions, child benefits, subsidised healthcare and free education that citizens of even the most debt stricken European nations take for granted.

At the moment the Government’s own figures show we have roughly $800 billion of assets and about $400 billion of net assets after CPF lending to the Government is deducted. This is either a colossal underestimate of the true figure (i.e. it does not include Temasek, Changi Airport Group or even all or the majority of the revenue from land sales) or else there has been mismanagement or fraud involving the nation’s assets on a grand scale. Either way laws and the Constitution have been broken.

Every year the Government makes a surplus of about $25-30 billion, perhaps substantially more. The accumulated surpluses since 1999 add up to about $300 billion. Yet our PM says nonsensical things, such as if we want Scandinavian levels of welfare, GST would have to rise to 20%. Even when we said that we would spend just $6 billion p.a., a quarter of the current surplus, on paying all those over 65 a basic Old Age Pension, giving mothers child benefit for every child up to 16 and abolishing Medishield Life premiums for the young and the elderly there was an outcry that this would bankrupt the country.

So what is going on and why is the PAP Government so determined to continue accumulating assets even if it requires keeping Singaporeans in a perpetual state of austerity? One is that the money is not there and that there has been a massive cooking of the books on the scale of, say, Greece. It has been either lost through mismanagement or misappropriation. Circumstantial evidence in favour of this is the PM, acting as Mr Lee Hsien Loong, decided to take out a lawsuit against an unemployed blogger and press for huge damages rather than just disprove his claims by releasing more information. More importantly the Government have failed to answer my questions about gaps in the Budget or discrepancies despite numerous open letters going back to 2012.

However on the whole this scenario still seems slightly less plausible than one in which greed still plays a major role though in less directly venal a manner. We do not know whether the PM is paid anything for being Chairman of GIC though the fact that GIC’s annual report fails to clarify this point suggests that he is. What is indisputable is that his wife’s compensation must be related both to the performance of Temasek and its level of assets. So the greater the level of assets managed by Temasek and GIC, the wealthier our royal couple become. This alone provides a powerful incentive to ensure that none of the wealth accumulated by Singaporeans’ hard work and forced savings are shared with the people.

The Greeks, who start with huge debts, have decided that they are better off repudiating those debts and facing an uncertain future. Yet Singaporeans, who could be extremely wealthy if the Government’s figures are correct, continue to put up with being treated as children and lied to by their Government. They have nothing to lose by demanding transparency and accountability. Yet every four years they happily re-elect the PAP after being promised a few hundred dollars in change from the Government’s back pocket while the same old secretive ways continue. That is the real mystery here.

Unfortunately, Ignorant, naive Singaporeans will only realize their errors of blind faith & loyalty when the captain and his motley crew start deserting the sinking Sintanic ship with their money loaded suitcases for the safety of their overseas mansions, ( purchased on their “Business” or holiday trips ) that they

realize that something serious is happening……..by which time, it will be too late to regret not treating the warning signs of your blogs with intelligence & respect.

Never mind. Your blogs have fulfilled their moral duty. You can do No more. The wise ones will remember and bless you for opening their hearts, eyes & mind..as they enjoy their remaining lives of peace & pleasure! The young ones will be

left to curse the memory of their foolish forbears further down the Lorong in the years to come….for their apathy..

LikeLike

How is it that when foreign journalists cite hard to take truths about Singapore, the authorities demand the right of reply. But when you actually demand answers from these very reasonable questions that many in Singapore will want to know, you can hear a pin drop on the other side. If you’re CEO’s. CFO’s and COO’s commanding huge salaries, isn’t a well argued reply the least we can expect? After all, we’re paying your salaries.

LikeLike

The gov’t and greater population evidently enjoy a sado-masochistic relationship. Thanks for highlighting these well analyzed examples to expose more hard truths to keep the opposition going. Keep punching.

LikeLike