An Familiar Tale of An Ordinary Singaporean and His Problems with An Unsympathetic HDB Bureaucracy

Recently someone posted to my timeline on Facebook an account of another person who claimed to have received unsympathetic treatment from HDB. I have inserted a screenshot of the Facebook post above. The post received nearly 5,000 likes very quickly. After reading about it I invited Mr S to come and see me at the Reform Party office. He came down to see me yesterday afternoon accompanied by a neighbour, Mina, who has been assisting him in his brush with the HDB and CPF bureaucracy.

Recently someone posted to my timeline on Facebook an account of another person who claimed to have received unsympathetic treatment from HDB. I have inserted a screenshot of the Facebook post above. The post received nearly 5,000 likes very quickly. After reading about it I invited Mr S to come and see me at the Reform Party office. He came down to see me yesterday afternoon accompanied by a neighbour, Mina, who has been assisting him in his brush with the HDB and CPF bureaucracy.

I will summarise his case briefly. Mr S was forced to sell his HDB flat in May 2012 because of debt problems. He is married with three children, two girls aged 19 and 16 and a young boy. Since he sold his HDB flat he has been living with his sister and her husband in their four-room flat. However his sister’s family now need the space back. Very sadly Mr S has recently been diagnosed with late-stage cancer and is no longer able to work. Previously he had his own business but I understand it was closed down due to insolvency. He is currently receiving $1,000 a month from ComCare, which is insufficient to cover his and his family’s needs.

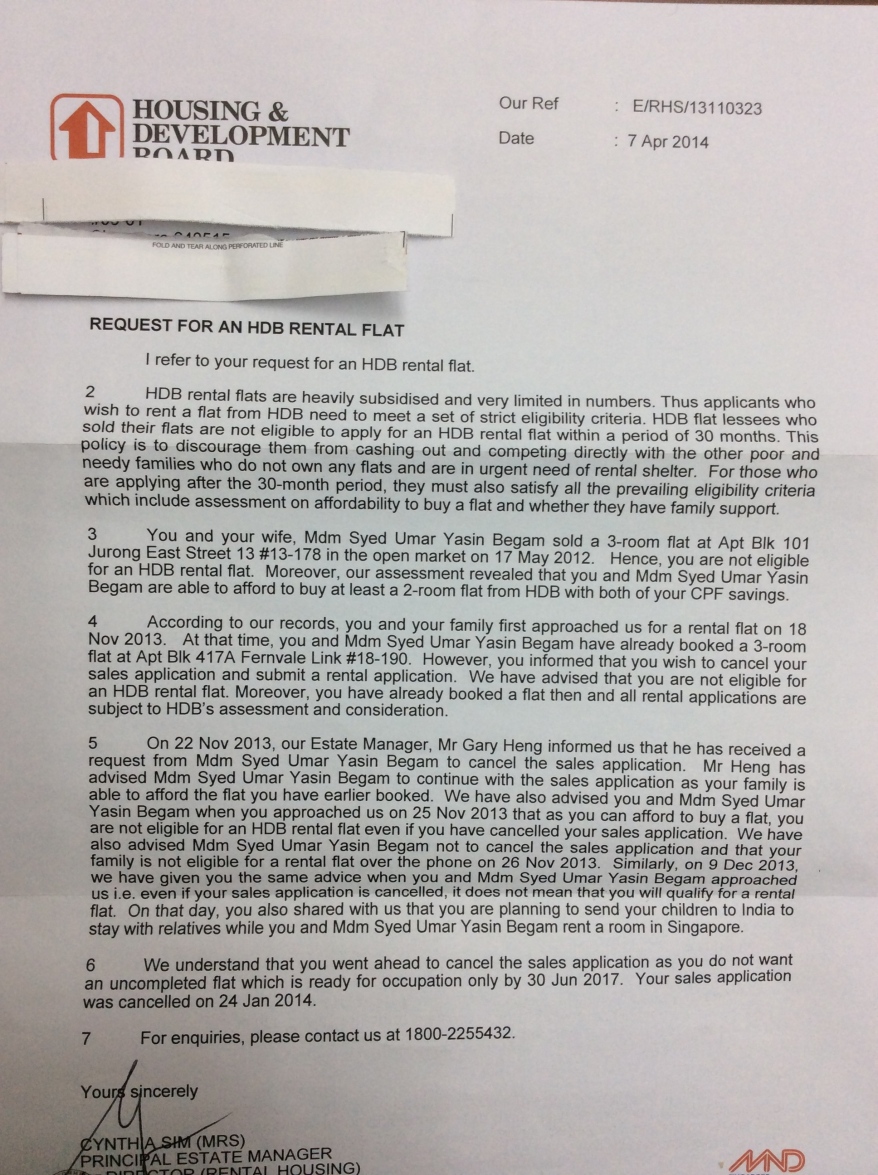

However, despite his lack of liquid assets or income, Mr S has over $200,000 tied up in his CPF Ordinary and Special Accounts. He applied for a BTO three-room flat last year and was successful in getting one. He put down a $1,000 deposit, which did not come from his CPF savings. Unfortunately the new flat will not be available till 2017 . He needs to find new accommodation immediately. He returned to HDB in November 2013 and requested to be put on the HDB subsidised rental scheme, as he cannot afford to rent a property on the open market. Mr S claims that the HDB rental officer told him that he could not be placed in the scheme, as he had already been successful in applying to buy a new flat. He then went and cancelled his application and forfeited his $1,000 deposit. However, after cancelling his application, he was told that he was ineligible as he had sold his former HDB flat less than 30 months before and furthermore his level of CPF savings was too high. HDB are denying that they gave him this advice and that they told him from the outset that he would not qualify for a rental flat.

Mr S had ended up in the Uniquely Singaporean trap of having substantial savings in his CPF but being unable to use any of it. As the PAP government has broken its promises and unilaterally and repeatedly tightened the rules on withdrawal, introducing first the Minimum Sum Scheme and now replacing that with CPF Life, it really looked as though Mr S and his family would end up homeless. The letter from HDB, which I reproduce here (with the names redacted), seemed to suggest that it was an acceptable solution for Mr S to send all his children to India while he and his wife rented a room.

Mr S and Mina told me that HDB was advised that Mr S was of the seriousness of his medical condition and that his life expectancy had been reduced. Therefore I find it staggering that none of the staff could advise him that there was a simple solution to his problem. CPF allows those who have a medical condition that significantly shortens their lifespan or who are permanently unable to work to withdraw their CPF savings provided they leave the Medisave Minimum Sum in their account. Mr S obviously qualifies. Since CPF and HDB are so closely connected it seems inconceivable that the staff are so poorly trained as to be unaware of this fact. Perhaps they are incentivized only to sell flats and not trained to give appropriate financial advice. Or they are told not to tell customers of this scheme as it might encourage Singaporeans to contract a terminal illness just so they can withdraw their CPF savings early? That would be exactly the PAP government’s way of thinking. I recall the PM in his National Day Speech 2013, advising Singaporeans that the best way to keep medical expenses down was just to stay healthy.

Mr S and Mina told me that HDB was advised that Mr S was of the seriousness of his medical condition and that his life expectancy had been reduced. Therefore I find it staggering that none of the staff could advise him that there was a simple solution to his problem. CPF allows those who have a medical condition that significantly shortens their lifespan or who are permanently unable to work to withdraw their CPF savings provided they leave the Medisave Minimum Sum in their account. Mr S obviously qualifies. Since CPF and HDB are so closely connected it seems inconceivable that the staff are so poorly trained as to be unaware of this fact. Perhaps they are incentivized only to sell flats and not trained to give appropriate financial advice. Or they are told not to tell customers of this scheme as it might encourage Singaporeans to contract a terminal illness just so they can withdraw their CPF savings early? That would be exactly the PAP government’s way of thinking. I recall the PM in his National Day Speech 2013, advising Singaporeans that the best way to keep medical expenses down was just to stay healthy.

Anyway I am pleased that I was able to point out there was a fairly easy solution to Mr S’s problem though sadly there is no miracle cure for the poor man’s illness. Tomorrow I will assist him in filling in the online application for early withdrawal. I will also go with him to see his MP in Jurong GRC at the next MPS and to HDB in order to try to get his deposit back. Mr S also wrote to PM Lee on his Facebook page and was contacted by an individual who took down the details. That was two days ago and he has yet to receive a response.

I would like to recommend Mr. S to try out Dr Joanna Budwig Diet for his cancer treatment. There are many publications online about Dr Joanna Budwig. She was a German pharmacologist, chemist and physicist. She discovered the healing power of simple inexpensive flaxseed oil and cottage cheese for cancer and other diseases. She treated approximately 2500 patients during a 50 years period with her healing protocol up to 2003 with over 90% documented success. She was nominated 7 times for Nobel Prize.

Please go here for more details and interesting read:

http://www.budwigcenter.com/the-budwig-diet.php

http://www.huldaclarkzappers.com/?page_id=204

LikeLike

Hi KJ,

I’ve just come across this PPHS rule in the latest issue of Singapore Property Weekly:

“Fewer couples applying for larger PPHS flats.”

“To encourage couples to take up larger flats, the government may allow couples to co-rent flats under the Parenthood Provisional Housing Scheme (PPHS). While 80 per cent of the 1,150 PPHS flats are occupied, applications have fallen from 409 in September last year to 81. Married and engaged couples who booked uncompleted Build-To-Order flats last year can apply under the PPHS.” (Source: Channel NewsAsia)

My point is: why did the HDB rental officer tell Mr. S that he could not be placed in the HDB home rental scheme, because he was applying to buy a new BTO flat?

Isn’t this Parenthood Provisional Housing Scheme (PPHS) an available alternative?

If the HDB rental officer meant MR. S was not qualified for the subsidized rental home, then did he offer Mr. S this Parenthood Provisional Housing Scheme (PPHS) to Mr. S? This could have been the way out for Mr. S to not cancelling his BTO application and not forfeiting his $1,000 deposit.

LikeLike

Hi KJ, there is something called HDB interim rental housing. That is why I say most often it is those below that are not doing their job well, rather than those on top.

http://business.asiaone.com/property/news/hdb-extends-interim-housing-scheme-more

LikeLike

Paul you are right. he can claim DPS. which is compuslory

LikeLike

well done

LikeLike

If he has terminal cancer, he should also be encouraged to claim from his DPS (Dependent’s protection scheme) which he would be entitled to if he is under 60.

LikeLike

Paul, thanks for pointing this out. The unfortunate gentleman is already aware of his rights to claim under the DPS.

LikeLike

A poignant story that deserves airing. It is clear some people need to be told/advised to do what they themselves should know better; some people need to be prodded or critiqued to follow rules they have set themselves.

LikeLike